Energy, Evolving

A trusted platform for private equity and infrastructure funds.

We help unlock value across the energy transition — from origination & due diligence, to strategy, turnarounds, and execution.

Operating as an expert-led, opportunity-driven partner — we help funds and their portfolio companies go faster, deeper, and unlock hidden value.

We engage flexibly — from short diagnostic work to long-term equity-aligned collaboration — across sectors including:

-

Public and private networks, merchant to contracted models — deep expertise in scaling zero-emission transport.

-

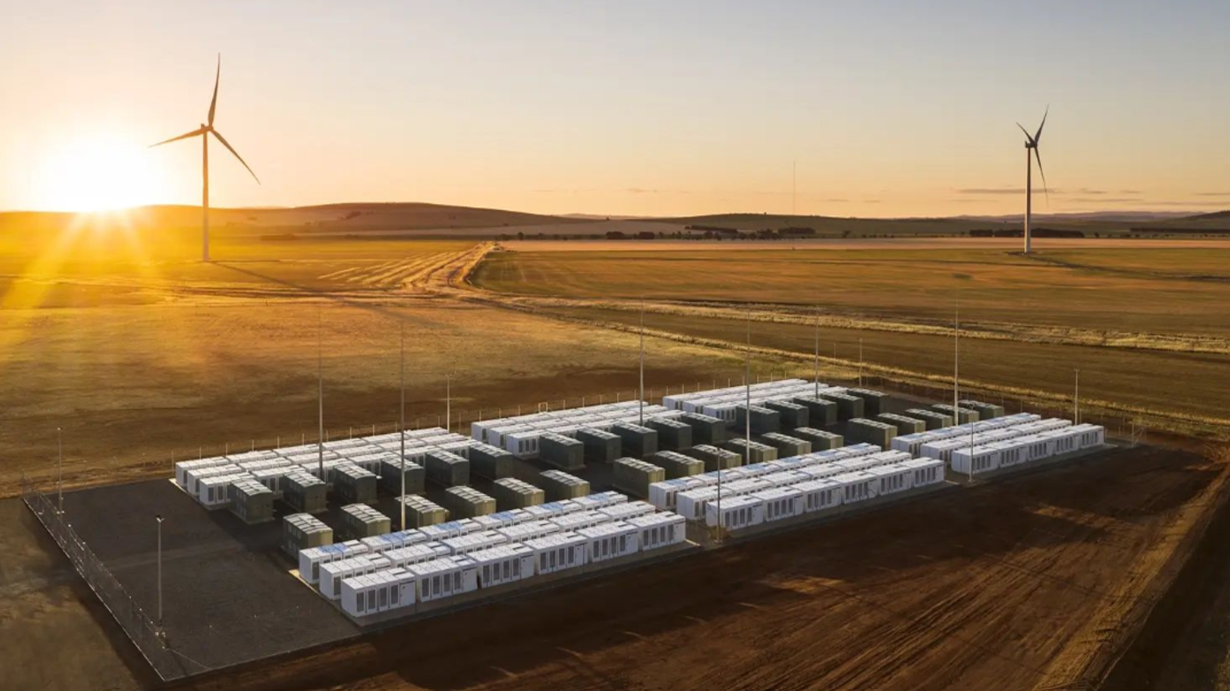

From origination to optimisation — we help deliver storage, flexibility, and heat as investable assets.

-

Product, go-to-market, and business model design — unlocking revenues from code to concrete.

Strategic support for funds across the value creation cycle.

-

Targeted sourcing of investable platforms, projects, or co-investors

-

Fast, expert insights across tech, commercial, and regulatory risks

-

Post-deal support to unlock commercial, pricing, and product levers

-

Rapid injection of senior capability to steady or scale a platform

-

We thrive on aligned incentives — via success fees, carry, or JV structures

Who we work with

Private Equity and Infrastructure Funds

Portfolio Companies

Founders and Platforms

Real Asset Owners

Family Offices and Strategic Investors

Why Enervolve?

Unlike traditional consultancies, Enervolve brings founder-level thinking, investor-aligned strategy, and sector fluency to every engagement. Whether the goal is growth, transition, or transformation — we unlock what others overlook.

Deep Domain expertise

Hands on, low profile

Plugged into what’s next

Aligned on outcomes

We’re connected to a new generation of talent — analysts, operators, and builders fluent in the technologies reshaping power: e-mobility, battery storage, electrified heat, and the software connecting them — with eyes on what’s next in flex, DERs, AI, and energy-embedded real assets.